With short-term interest spiking thanks to the Federal reserve’s aggressive rate hiking cycle, the yield on short term treasuries have reached levels not seen in several years.

In fact, the rates for the 1 year and 2 year treasury bonds are much higher than the average APY on the highest of high yield savings accounts and CDs (Certificate of Deposits).

In simple terms, this means that buying an essentially risk free treasury, which is backed by the full faith of the US government, is a much better place to park your cash in the near term.

Especially given the volatility in stock markets and soaring inflation which makes a big dent on cash savings lying in checking or low yielding savings accounts.

So why did I decide to buy a short-term US treasury bond? The answer is that it currently offers the best risk-free return over the next 12 months for my cash holdings versus leaving it in a relatively low yielding CD or saving account.

Unlike my experience buying I-Bonds a few months ago directly via the Treasury, which I still recommend, buying US treasuries can be done via most brokerage accounts.

The process is essentially the same for most brokerages, but there are a few things to be aware of that I will highlight as I walk through my step-by-step process of buying US treasuries via my Fidelity account.

Buying a US Treasury

So a US treasury is basically a bond, which is what you need to navigate to in your brokerage account. I recommend doing this on your desktop browser, if doing it for the first time. Lots of details and hard to see all of it on your cell phone.

Note: A 1 year or shorter duration treasury is none as a treasury bill. A 2 to 10 year treasury is known as a treasury note. If it is generally longer than 10 years, it is known as a treasury bond.

In Fidelity this is found via the Investment Products -> Fixed Income, Bonds and CDs. For Vanguard, another popular fund manager, you can find this via the What we Offer, and Bonds sub-link.

In both instances you will get taken to a Landing page, which will say Search for Investments or Get Started. Click on this to start the bond buying process.

Placing the order

This is where it gets a little tricky and I strong encourage you do your research on what bonds are and how they work. E.g. you should be able to answer the question why price and yields move inversely/opposite to each other.

Both Fidelity and Vanguard have good investor education resources so I recommend you review those before making any purchases.

I am not going into Bond 101 concepts in this article as my focus here is on buying a short-term high yielding treasury bill to park some cash instead of leaving in a low yielding CD or saving account. I have done my research and it is clear the 1-year US treasury offers the best return at this point in time.

I am also focused on buying a new offering (released weekly) versus one on the secondary/reseller market. The main reason is that plan to hold to maturity and generally to buy on the secondary market you need lots more money than the $20,000 I am starting out with.

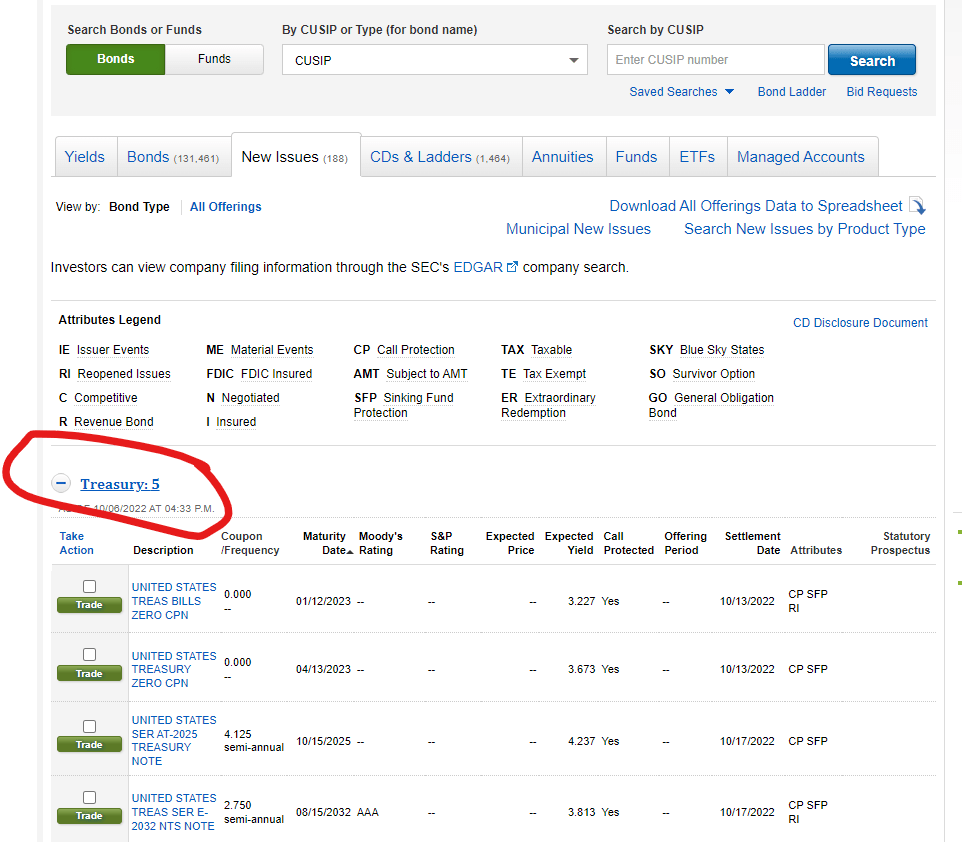

Most brokerages offer many types of bonds, so you need to be careful to pick the right one. For my case since I wanted a new issue Treasury bond that I wanted to hold for the entire one year term, I went to the New Issues tab and to the Treasury section. on the Fidelity platform, this should be the first section.

As you can see from the plasmale screenshot below, you will likely only see a few Treasury products. Look at the maturity date to determine the duration of the treasury you want. I went for the one 52 weeks out.

You can then hit the Trade (buy) button next to the relevant treasury which will then show you features of the bill and allow you to enter the amount you want to buy. Treasuries are bought in increments of $1,000.

Hit the Preview Order button which will show you a summary of what you are buying and the expected yield. If all looks good, hit buy and you are done!

Reviewing the Purchase

It may take a few days for the order to close since new releases by the treasury have a certain bidding and allocation process that can take some time to complete.

When the trade is done, you should see the following line in your Portfolio holdings. It will look like a strange number, but this is just the CUSIP number the Treasury uses for their bond issuance.

The current value reflects the discounted or interest rate payment factored into the bond. The current price will fluctuate over time, but because I plan to hold the bond to maturity I will get the full 20,000 back. So basically the Current value + Accrued Interest Payments = Bond Value ($20,000)

To view details on the bond, click on the Bond name and goto the “View Fixed Income Analysis” screen. You can also see the View Details link, but I found on Fidelity the fixed income analysis page is more concise and clear for retail investors.

You will see all your bond holdings and CDS (“Fixed Income”) on this screen. It will show the estimated Yield and value. You can click the CUSIP number for more details

You can choose to sell/trade this one year treasury bill at any time before maturity, but if like me you plan to hold this to maturity there is not much need to monitor this. Fidelity or your preferred broker will close the trade (assuming you didn’t select the rollover option) at maturity and return the cash to your account.