Like many tax payers I continue to check the status of my IRS refund payment and face the rather unhelpful status message below that my return is still being processed! After several weeks of checking daily this message gets old, fast.

I wrote about the earlier delays with getting my refund processing started due to completing return/ID verification checks following an IRS letter (5071C).

But after successfully doing that, I started seeing the message above – for several days! So I decided to check my IRS account for more details and saw that my 2022 tax transcript was now showing up! Progress, or so I thought.

Your IRS transcript (which is free via your IRS account) is only available after the IRS starts processing your tax return.

If they haven’t yet started you will see a message like this on the IRS WMR refund status tool. Your transcript for the relevant tax year will just show N/A – so the transcript is not much help unless initial processing has occurred.

What can my transcript tell me About My refund status?

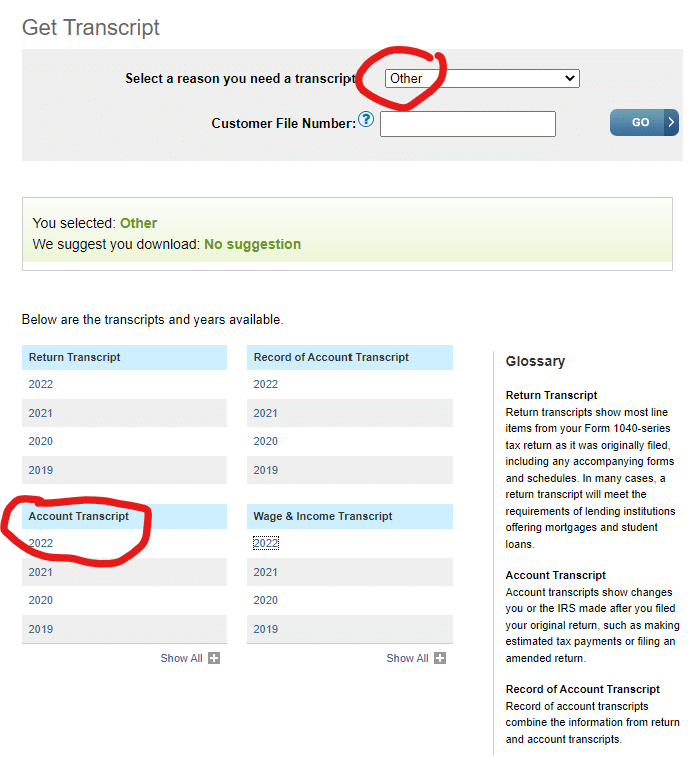

Once you get to your transcript (just select “other” for reason) you will see the following screen which will show you the various transcript types. Just click the Account Transcript Link (e.g. 2022 for your 2023 refund payment) to get more details. A PDF of your transcript will open.

Code 570 on My Tax Transcript – Refund Freeze

You can see this article for details on what your tax transcript will tell you and what the various codes mean, but mine showed the following details.

The main code which provided an update, beyond the WMR processing status, was code 570.

I have a detailed article on what code 570 means on your tax transcript, but essentially it means that my return is under further IRS review following initial processing. No refund will be paid (it’s frozen essentially) until the review is complete or a notice for additional information is sent.

Now I don’t know the exact reason why it was sent for additional reviews. But I know it is not ID verification, I already did that, which allowed it to process to this point.

Likely reasons include some mismatch with what I filed vs what employers or other financial organizations that sent me money during the tax year reported to the IRS. It could also be the precursor to an audit (gulp!). It could also be due to IRS staffing shortages which result in delays to process tax returns that require manual reviews.

In any event there is not much I can do other wait for an IRS letter (which will show up as code 971 on the transcript) or for processing to complete based on auto-adjustments by the IRS.

Calling the IRS didn’t help much either as I was pretty much told the same as above, that I just need to wait for my return to reviewed.

I now see a 971 code after my 570 code – What does this mean?

So after a week or two, I saw a 971 code pop up on my transcript. The date on this line was different, but the amount was zero. So what does this mean?

TC 971 is essentially the generic code for an IRS notice or letter that should provide more details on the issue delayed your return/refund processing. Sometimes you may be able to able to see this notice on your IRS account, but in most cases you will just have to wait for the notice to be mailed to your filing address.

Once you get the notice, ensure you act promptly so that the IRS can continue processing – assuming they need information from you.

The notice may also be an advisement of further IRS delays (e.g additional 60 day review) to review your situation. This unfortunately, will mean an extended delay to your IRS refund processing.

Date and Cycle Code

The other new piece of information from my transcript was the “05-22-2023” date against code 570 and refund cycle code (20231805).

The date on the code 570 does not mean much as it is system generated and an estimate of the next action date.

But the cycle code, 20231805, shows that I am a weekly account update cycle – that’s what the last 05 digit means – with my last processing on Thursday, May 4, 2023. See this article on how to interpret your refund cycle code.

Being on “05” cycle means my return is likely only updated on a weekly basis, on Thursdays. So my status (and transcript) will likely only update once a week – which I will see Friday mornings – unless manually changed by an IRS agent after their review.

I’ll probably still check my refund status and transcript every day (it only updates once a day), given I am anxious to get my refund, but at least now I know more and know the IRS is processing my return.

Unfortunately my wait continues….

I’ll update what happens next and you can subscribe to our free newsletter to get the latest updates.